Let’s start with a few facts about Bitcoin

- We’re at around 19.69 of 21 million Bitcoin mined;

- Every 10 minutes a new ‘block’ is mined, rewarding a miner with 3.125 new BTC.

- This production rate halves every 4 years (it’s called Halving, next in 2028), and will eventually come to a complete stop.

- One BTC = 100.000.000 ‘satoshis’ or ‘sats’, the smallest, divisible units of Bitcoin.

The economic law of ‘Supply & Demand‘ implies: scarce supply and increased demands increases a price.

So how does this law apply to Bitcoin?

The demand of Bitcoin might keep rising for many reasons

- Every day new individuals get acquainted with Bitcoin and might actually understand why it matters so much.

- Emerging economies allow new populace to get enough financial means to get their own sats.

- People get stuck in economies or countries suffering from strong (hyper)inflation, desperately look for ways to preserve the value of their savings

- Avoid strict government regulations surrounding personal finances (CBDC’s, privacy…)

- Increased globalization means more international transactions, but need to bypass political/financial restrictions, exchange rates, borders, totalitarian regimes, fraudulent middle-men, banks…

- New private & Institutional investors want to jump on the bandwagon during a parabolic rally

- People need Bitcoin to buy very specific goods and services, only offered in BTC.

But the supply actually keeps reducing on the long term

“But you just said every 10 minutes 6.25 BTC is mined?” – Yes, but…

With Bitcoin, you become your own bank with an unhackable vault. The safekeeping of its private key (the combination) becomes your responsibility.

Once said key is lost, the funds in the wallet can NEVER be retrieved.

Lost coins are locked and gone forever, actually reducing the supply.

Believe me when I say that many, perhaps millions of Bitcoins have already been lost:

- Someone passing away, without telling anybody how to get to their coins

- Hard drives dying containing private keys, without back-up.

- A virus or cryptolocker permanently destroying your data, and thus wallet

- Encrypted computers stolen, containing private keys without (cloud) back-up.

- Faulty transactions to locked/inactive/erroneous wallets

- Natural disasters destroying paper wallets and/or drives

- People forgetting they actually have Bitcoin, let alone remembering their private key (yes it happened)

- Funds forever stuck on exchanges due to lost username/passwords or lost 2FA ‘secret keys’ (this has happened way too often)

- Remaining ‘dust’ on exchanges. Imagine someone trying to withdraw their last ‘0.03’ Bitcoin in 2015. The transaction fees would have been too high. Or it just wouldn’t have been worth your time. What seemed like ‘dust’ back then, is now worth much more.

- When Bitcoin was still dirt-cheap back in 2009-2010 people just didn’t care if they’d lose 1.000 BTC, worth maybe a dollar. Remember, in 2010 some guy bought two pizzas in Florida for 10,000 BTC. (Which is getting close to this episode of Futurama)

- Confiscated (and sometimes destroyed) Bitcoins by governments

- Increasing amounts of private long-term investor-‘believers’ who will try to pass it on to their great grandkids (also known as the true HODL’ers or maximalists/maxis) They usually try to get at least 1 full BTC.

The supply of BTC is already much smaller than believed

I strongly reccomend you to take a look at the Bitcoin Richlist of dormant addresses. It’s extremely impressive but may also be a good indicator as to what amounts I’m talking about. I sincerely hope for these people they still have their keys, but I doubt it for most of them.

Nobody knows exactly just how many of today’s ~19.69 million existing Bitcoins are lost forever. I’d say a few million at least. Update: These guys estimate it’s 3.7 Million

Finally keep in mind

This leaves just 0.002 BTC per person on this planet. However: a few hundred, perhaps one thousand “whales” hold most of the ‘non-lost’ Bitcoin. And then there are the hundreds of thousands of people who own at least 1 to 100 BTC who will perhaps never sell.

Makes you think. I remember doubting Bitcoin at some points in the past few years, but this list has me convinced it’s here to stay:

- Bitcoin has value (that what people ‘believe’ its worth, that what people payed for it and of course: the cost of energy and hardware)

- Bitcoin is an easy way to send any value from A to B across the planet to anybody. Banked or unbanked, within minutes and at relatively low cost, especially via Segwit or Lightning.

- Bitcoin knows no discrimination or restrictions.

- Bitcoin is 100% tamper-proof. You can not fake or fraude a Bitcoin transaction.

- Bitcoin is hyper portable. Even by memory.

- Bitcoin knows no borders or regimes.

- Bitcoin knows no central banks.

- Bitcoin needs no expensive vault

- Bitcoin knows no ‘downtime’ (just slow transactions)

- Bitcoin is perfectly traceable.

- Bitcoin cannot be seized or blocked.

- Bitcoin does not need intermediaries.

- Bitcoin is deflationary, but highly divisible.

- Bitcoin can not be printed and created out of thin air by printing extra.

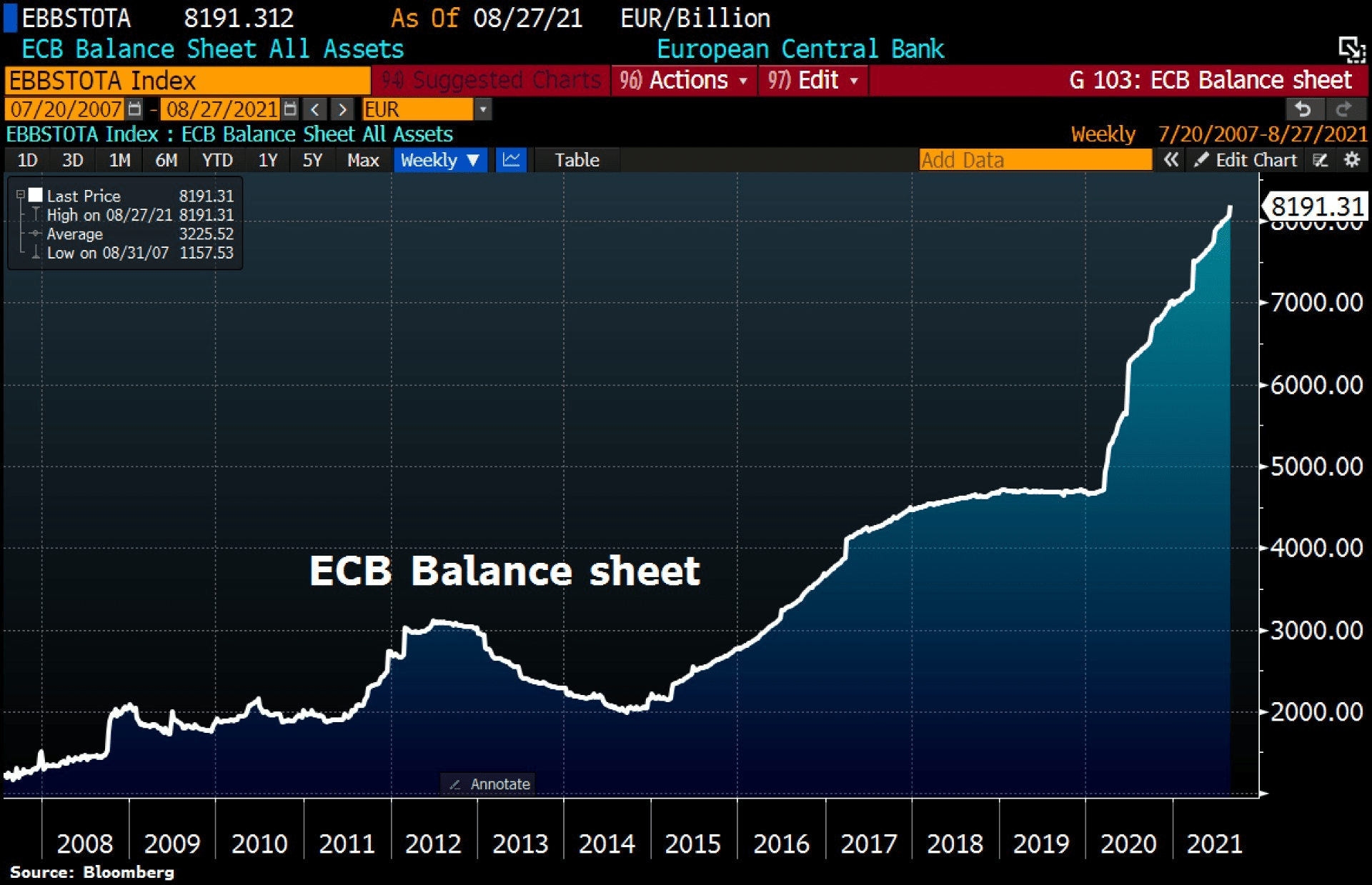

Now there’s this fact (just in the USA): Every day, the Bureau prints approximately 38 million pieces of paper money. About 45% of this production are $1 bills and 25% are $20 bills. The rest of the production is divided between $5, $10, $50, and $100 bills. (source) The same happens in every continent. And especially since Covid, printing -and therefore inflation- has gone through the roof.

So I’m asking you: Would you rather have 30.000 USD or 1 BTC? (or whatever its current price is)

Or let me rephrase: It’s 2035: which holds most value: 30.000 USD or 1 BTC?

Disclaimer:

I don’t want you to take this article as ‘FOMO’ (fear of missing out) investment advice. Investing is always risky and your own, full responsibility. Never make any hasty decisions you are willing to regret.

1 thought on “12 Reasons Bitcoin is getting more valuable every day (Hint: price has nothing to do with it)”

Seems you were 100% spot on. Nice one man!